Climate change poses challenges and opportunities for the Aboitiz Group across current and future investments, and the communities it operates in. Proactive management includes thorough assessments of physical, transition, and liability risks to develop strategies, adapt operations, and enhance resilience to climate impacts.

The Aboitiz Group’s SGRPT Board oversees climate strategies and programs, while the Board Risk and Reputation Committee addresses climate risks. Tactical approaches and risk management are implemented by the Management Committee and ESG Technical Working Group.

Strengthen oversight, governance, and policy reviews to meet evolving climate regulations, and enhance synergy and climate risk training across teams.

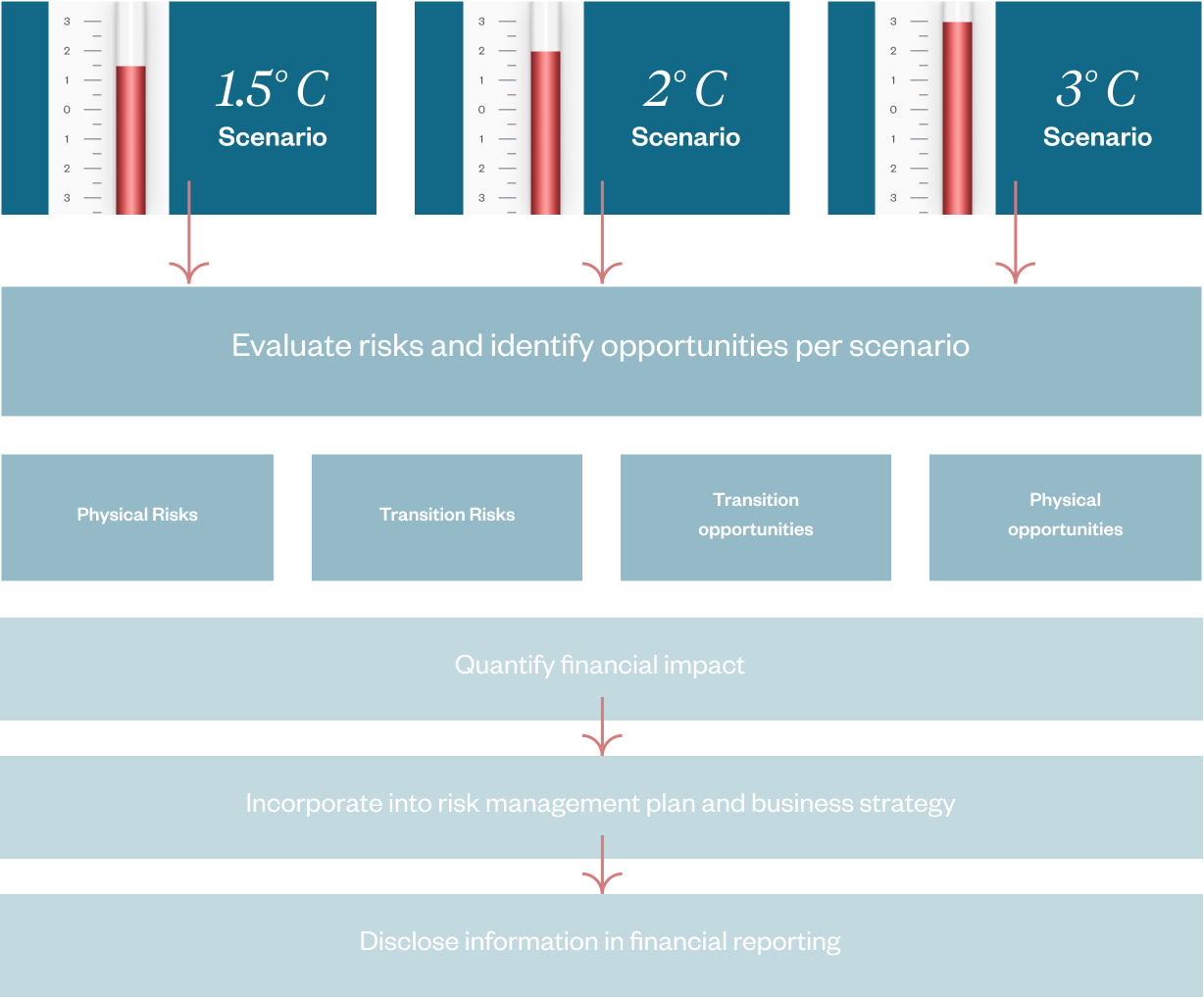

The Aboitiz Group’s Climate Value at Risk Study done in 2021 led to the Climate Risk Scenario Analysis Process, integrated into company-wide risk management to evaluate investments under 1.5°C, 2°C, and 3°C scenarios. This process assesses physical and transition risks, incorporating findings into strategy, financial planning, and project valuation to account for climate-related costs and potential impacts on returns.

Refine our strategy by strengthening climate risk assessments, optimizing portfolio structures, leveraging transition opportunities, reducing emissions, and incorporating lessons learned and risk evaluations into investment decisions.

The Climate Scenario Analysis Process is continuously being integrated in the Enterprise Risk Management System to account for climate related risks in the Group. Climate Change Risk is now part of the top Groupwide risk. In line with this, our process of identifying, assessing, managing, and establish risk transfer mechanisms identified in our operational risk management plans is continuously conducted across our business units. In our Climate Value at Risk Study we found out that the biggest risk to the company’s business operations, revenues and expenditures are associated with reaching emission reduction targets based on the country’s Nationally Determined contributions under the 1.5-, 2-, and 3-degree scenarios. Impact is calculated by discounting a future time series of costs based on annual emission reduction requirements and carbon price estimates in accordance with global temperature targets and various integrated assessment models (IAMs). The most significant climate-related physical risks to the company and its business units are intense tropical cyclones, flooding, and extreme heat (resulting in drought). Most of the mitigating actions reside at the business unit level.

At AEV level, this is being managed by assisting the SBU/BU in the procurement of insurance. To manage these risks, AEV has started requiring all business units to assess and quantify the impact of a 1.5°C, 2°C or 3°C scenario on all new investments as part of the investment approval process. Methodology and assumptions were in line with those used for the existing assets. This analysis shall be incorporated in the standard sensitivity/scenario analysis charts. On top of this, business units are also being monitored on their performance against internal climate-related targets.

Emissions Metrics: Refer to this page for the latest data.

Potential Risk Metrics: Based on the Natural Catastrophe (NatCat) study, our maximum potential exposure for typhoon-related damage is around PHP33.7 billion (USD608.6 million) on a 1-in-250 years return period assumption. Occurrence of natural catastrophes such as typhoons can be further exacerbated by flooding and extreme precipitation.

Opportunity Metrics: We have identified opportunities brought by climate change based on 1.5°C, 2°C, and 3°C scenarios. For Transitional Opportunities, the impact is calculated by discounting a future time series of profits to the present value and dividing this value by the current company value. It will also be expressed as a percentage of the company’s market value, in accordance with global temperature targets and calculated using carbon prices from various integrated assessment models (IAMs). The estimated annual financial positive implications of identified opportunities is PHP163.0 billion (USD3.0 billion) under the 1.5°C scenario and PHP4.4 billion (USD80.2 million) under the 3°C scenario. These values are estimated green profits through 2080, adjusted for AEV’s ownership stake in different business units.

Further improve and redefine assessment tools and methodologies, and integrate them into operational risk assessment processes.

Integrate climate-related risks and opportunities in our Enterprise Risk Management System through risk assessments and operational risk management planning.

Report on decarbonization initiatives and progress towards Paris Agreement alignment Enhance, review and assess GHG inventory emission methodology for calculation Integrate Inventory of Scope 3 significant emissions in the SBUs.